south dakota property taxes by county

If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would be 85. Click here for the latest information on motor vehicle titling and registration.

Farm Property Taxes Part Ii A Geographical Look Agricultural Economic Insights

To view all county data on one page see South Dakota property tax by county.

. See Results in Minutes. TaxProper did a great job answering any questions I had about the process and their service. I would recommend them anytime for tax appeal needs.

To protect your privacy this site uses a security certificate for secure and confidential communications. If a county falls below the 85 rule a factor above 10 may be applied. If you would like to pay your Property Tax by credit card we accept Discover Visa and Mastercard.

TaxProper did a great job answering any questions I had about the process and their service. Ad Our Search Covers City County State Property Records. As Percentage Of Income.

To 5 pm Monday - Friday. In our example the City Tax Request is 172378 and the City Current Taxable Value is 24299059. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised value and 4 be held taxable unless specially exempted.

Motor vehicle collections are divided between the county cities townships and the state of South Dakota. Motor vehicle fees and wheel taxes are also collected at the County Treasurers office. Courthouse will be CLOSED on May 30th in honor of Memorial Day.

View the Freeze on. SDCL 10-24 In South Dakota property owners have a period of time during which they can repurchase redeem their property by paying the amount owed including taxes interest penalties and additional costs incurred. Across the state the average effective property tax rate is 122.

I had a fantastic experience getting my property tax deal processed through TaxProper. South Dakota laws require the property to be equalized to 85 for property tax purposes. Payments can be mailed to Pennington County Treasurer PO Box 6160 Rapid City SD 57709.

Taxation of properties must. As the tax collector is responsible for collecting all property and mobile home taxes for the county cities school districts sanitary districts and any other political district authorized to levy real estate taxes. The states laws must be adhered to in the citys handling of taxation.

South Dakota laws require the property to be equalized to 85 for property tax purposes. 1st Floor Courthouse Office Hours. The Treasurer is not only responsible for collecting property taxes for the county but the city and school districts as well.

Most credit cards are an acceptable means of payment with the exception of American Express. Appropriate communication of any rate hike is also a requisite. Email the Treasurers Office.

For additional information about your propertys. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. Deadline for Sales or Property Tax Refund - July 1st.

SDCL 10-24-1 Person can redeem property sold at sale at any time before tax deed is issued amount to. Renew Your Vehicle Registrations Online. For more details about the property tax rates in any of South Dakotas counties choose the county from the interactive map or the list below.

Bennett County collects on average 133 of a propertys assessed fair market value as property tax. 104 N Main Street. 53 rows On average homeowners pay 125 of their home value every year in property taxes or 1250 for.

If the county is at 100 fair market value the equalization factor is 085. Beadle County Courthouse 450 3rd Street SW 201 Huron SD 57350. Convenience fees 235 and will appear on your credit card statement as a separate charge.

Please notate ID wishing to pay. Homeowners living in a primary residence in. Request Value Tax Rate.

Karthik saved 38595 on his property taxes. Welcome to Day County South Dakota. Redemption from Tax Sales.

If taxes are delinquent please contact the Treasurers Office for the correct payoff amount and acceptable forms of payment. You can look up your recent appraisal by filling out the form below. Please call the Treasurers Office at 605 367-4211.

Find Out Whats Available. If your taxes are delinquent you will not be able to pay online. M-F 830-500 No transactions will begin after 440 pm.

Tax rates set by local government bodies such as municipalities and school districts are applied to the full market value of residential property. License Renewals are due for HIO by May 31st. Look Up Any Address in South Dakota for a Records Report.

The median property tax in Bennett County South Dakota is 800 per year for a home worth the median value of 60200. The forms are also available to download through the South Dakota State website. Please call our Customer Service department at 605-394-2163 for details.

Nonagricultural properties for each county. 33 rows South Dakota Property Taxes by County. A County Auditor needs to know the Taxable Value of the taxing entity from the growth form and its current Tax Requested.

The process was simple and uncomplicated. The average yearly property tax paid by Bennett County residents amounts to about 166 of their yearly income. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County.

Then the property is equalized to 85 for property tax purposes. To 5 pm Monday - Friday. The median property tax in South Dakota is 162000 per year based on a median home value of 12620000 and a median effective property tax rate of 128.

When you provide a check as payment you. A home with a full and true value of 230000 has a taxable value 230000 multiplied by 85 of 195500. For questions please call our customer service department at.

Julie Hartmann Turner County Treasurer 400 S Main Box 250 Parker SD 57053 Phone. ViewPay Property Taxes Online.

Here S How Much Tax You Ll Pay On A 2 Million Home In Each U S State Real Estate Places To Visit Real Estate Marketing

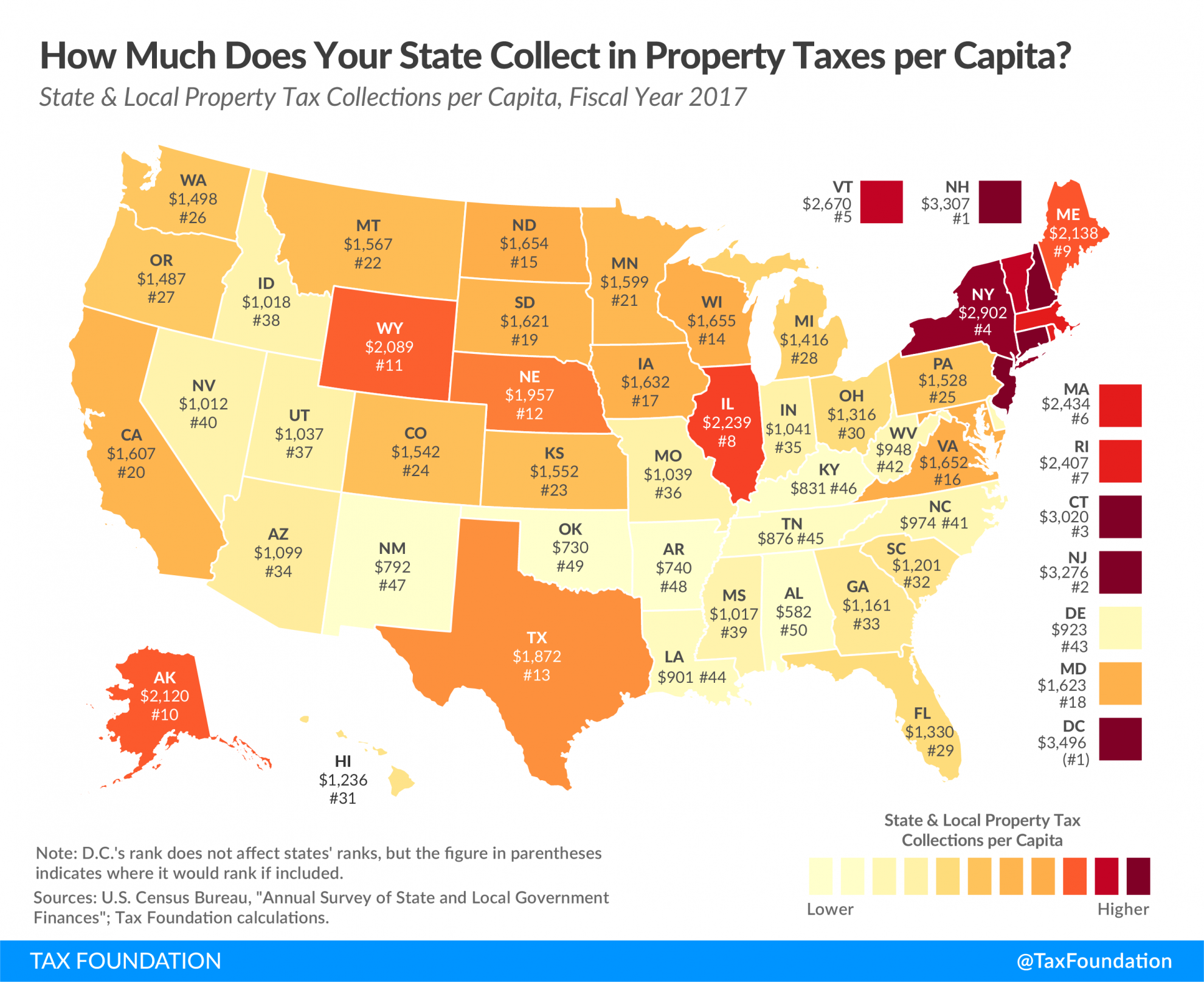

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Property Taxes By State In 2022 A Complete Rundown

Property Tax Definition Learn About Property Taxes Taxedu

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Property Taxes How Much Are They In Different States Across The Us

Property Tax South Dakota Department Of Revenue

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Small Towns Usa States

Thinking About Moving These States Have The Lowest Property Taxes

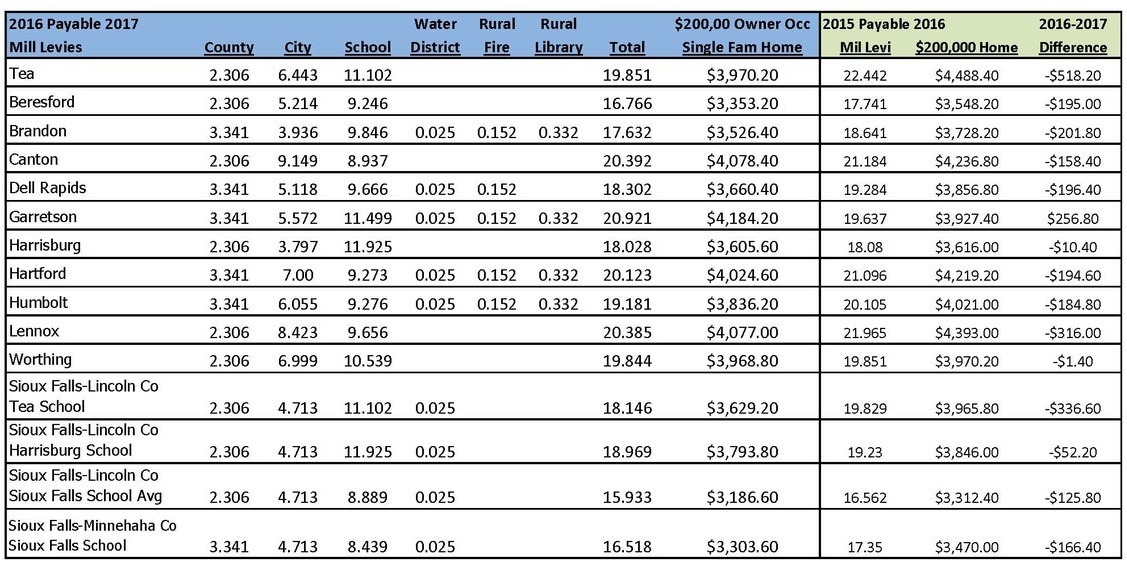

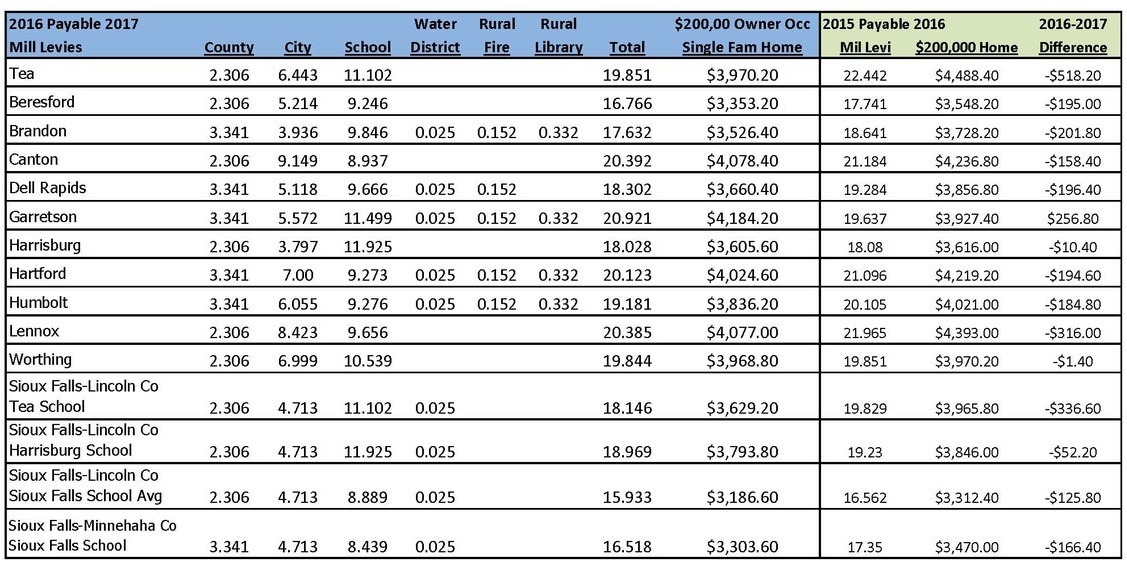

Tax Information In Tea South Dakota City Of Tea

Property Tax Comparison By State For Cross State Businesses

How School Funding S Reliance On Property Taxes Fails Children Npr

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Tax Property

South Dakota Property Tax Calculator Smartasset

North Georgia Horse Farm Close To Milton But Resides In Cherokee County Lower Taxes 4 6acres 4 Stall Barn With Tac Maine House House Styles Horse Property

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates