wisconsin private party car sales tax

But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit. In addition there may be county taxes of up to 05 along with a stadium tax of up to 01.

A Complete Guide To Car Dealer Fees Carfax

If not applying online a Title and License Plate Application Form MV1 A Bill of Sale is not required but is recommended.

. That tax rate is 725 plus local tax. A completed TitleLicense Plate Application Form MV1. If you have questions about how to proceed you can call the department at 608 266-1425.

Car Tax By State Usa Manual Car Sales Tax Calculator Free Wisconsin Motor Vehicle Bill Of Sale Pdf Eforms Free Bill Of Sale Forms By State Download Fillable Pdf Templateroller Share this post. In addition there may be county taxes of up to 05 along with a stadium tax of up to 01. WisDOT collects sales tax due on a vehicle purchase on behalf of DOR.

25000 for the injury or death of a single person. For both the online and mail-in options. Publication 202 517 Printed on Recycled Paper.

Car has out of state plates Illinois 6 replies TN resident buying car in NC frm private seller -. 50000 for the injury or death of more than one person. You may be penalized for fraudulent entries.

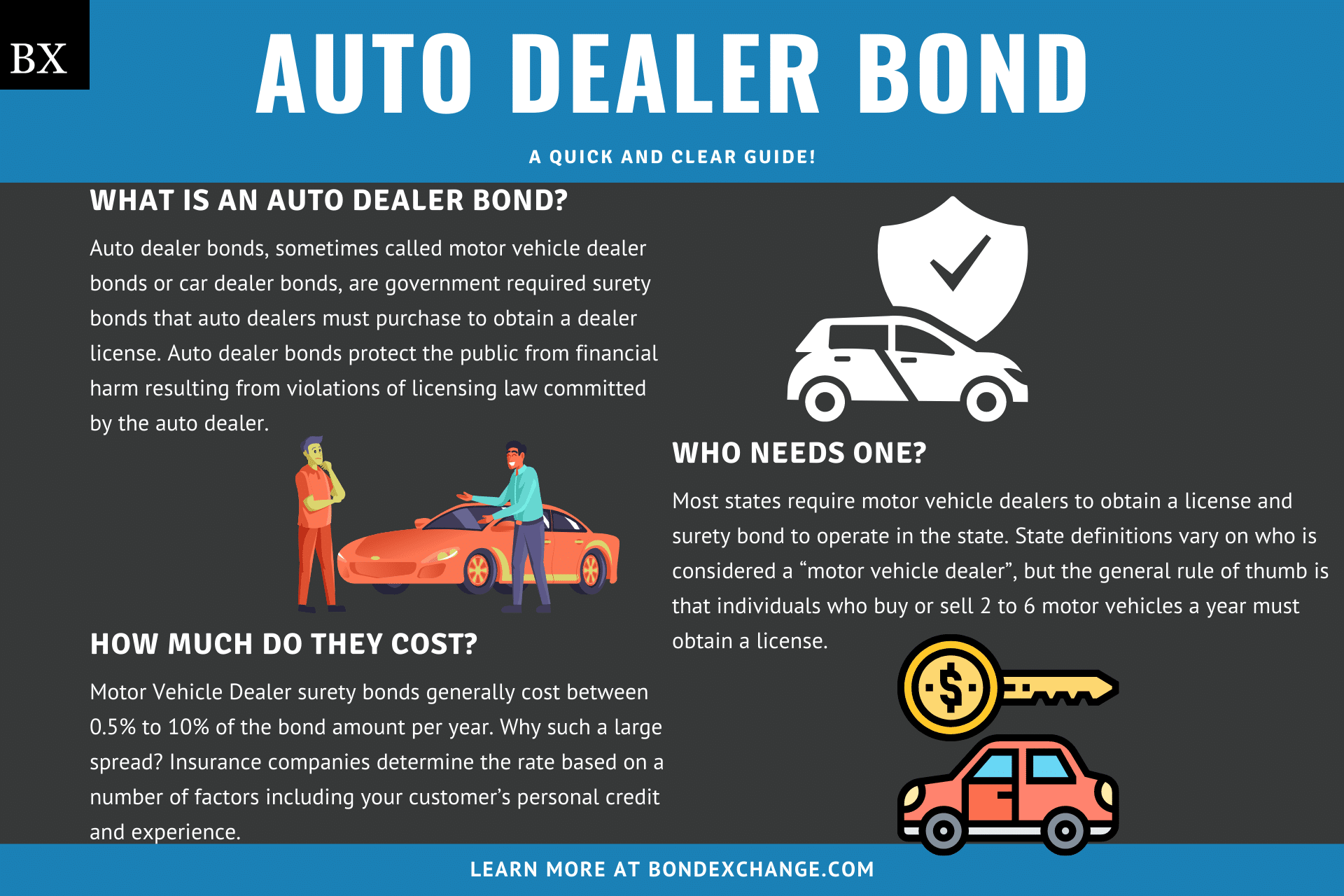

WI Drivers license or ID card. Get a dealer license to sell more than five vehicles a year. 5 One-Time Registration Fee UT510 Manual.

The Wisconsin Department of Revenue DOR reviews all tax exemptions. The most expensive standard sales tax rate on car purchases in general is found in California. The buyer pays it upon registering the vehicle.

If you sell more than five or if you buy even one vehicle for the purpose of reselling it you must have a de aler license. Car title transfer private party car buying Michigan 1 replies AZ resident buying private party auto in IL Illinois 1 replies Buying car from private party. Contact the DMV Dealer Agent Section at 608 266-1425 or.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. Wisconsin private party car sales tax. Wisconsin private party car sales tax Saturday March 5 2022 Edit.

If the vehicles title has been lost stolen or badly damaged you can apply for a replacementduplicate Wisconsin title online and receive your title in the mail within 7-10 business days of the online application being completed. Recreational vehicles as defined in sec. Are drop shipments subject to sales tax in Wisconsin.

In Wisconsin drop shipments are generally subject to state sales taxes. You may have to hire an attorney if the department cannot resolve the issue to your satisfaction. How Much is the Average Sales Tax Rate on Cars.

Wisconsin private party car sales tax Friday March 11 2022 Edit. Drivers license or other valid photo ID. Call DOR at 608 266-2776 with any sales tax exemption questions.

Private party car tax differs from dealer sales. The average sales tax rate on vehicle purchases in the United States is around 487. This Arizona TPT exemption prevents the nonresident purchaser from having to pay tax in both states.

Im not trying to avoid paying sales tax Im just trying to make sense of how WI can collect sales tax on a sale that was in another state. Form RUT-50 is generally obtained when you license and title your vehicle at the local drivers license facility or currency exchange. Youll also need registration documents which include.

In addition there may be county taxes of up to 05 along with a stadium tax of up to 01. Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles. Important Changes Menominee County tax begins April 1 2020 Baseball stadium district tax ends March 31 2020 Outagamie County tax begins January 1 2020 Calumet County tax begins April 1 2018.

Payment for the fees due including. Any taxes paid are submitted to DOR. I purchased a car in Minnesota from a private party and live in Wisconsin Im aware when I register the vehicle and transfer title at the WI DMV Im required to pay Wisconsin sales tax.

The national average state and local sales tax by. Wisconsin residents must pay a 5 percent sales tax on car purchases plus county taxes of up to 05 percent Some counties also charge a stadium tax of 01 percent notes the Wisconsin Department of RevenueFor example the state and local sales tax on vehicles registered in Bayfield County is 55 percent. Posted onFebruary 8 2021by.

Private party sales within most states are not exempt from car tax but unlike dealer transactions the seller does not collect the car tax. If you need to obtain the forms prior to registering the vehicle send us an email request or call our 24-hour Forms Order Line at 1 800 356-6302. Form RUT-50 Private Party Vehicle Use Tax Transaction Return.

You may have to hire an attorney if the department cannot resolve the issue to your satisfaction. Odometer reading if applicable. Sales and Use Tax.

However if a vehicle. Proof of insurance that meets the minimum state requirements. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

Sales of watercraft by a private party. You can also apply by mail with form MV2119. Motor Vehicle Sales Leases and Repairs.

Wisconsin private party car sales tax. Wisconsin law says you can sell up to five vehicles titled in your name in 12 months. Lease or lienholder paperwork if applicable.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. Any taxes paid are submitted to DOR. Editable Private Party Car Bill Of Sale Template Doc Sample In 2021 Bill Of Sale Template Private Party Templates Free Printable Mileage Logs Report Template Printable Chart Mileage.

Proof of WI car insurance. However certain states have higher tax rates under certain conditions. The sales tax charged on car purchases in Wisconsin is 5 so you can expect to pay at least 5 of the total vehicle price for the tax fee.

Drop shipping refers to the common business practice in which a vendor often in a different state makes a sale of a product which is shipped to the end-user by a third party supplier hired by the initial vendor. Effective October 1 2009 all retailers that are registered to collect and remit Wisconsin sales and use taxes must also collect and remit the applicable state county andor stadium sales and use tax on its sales of the following items. 42-5061 A 28 a link is external provides an exemption from state TPT and county excise tax for sales of motor vehicles to nonresidents from states that do not provide a credit for taxes paid in Arizona.

Never On Sunday How About Buying A Car Minnpost

How Much Cheaper Are Cars At Dealer Auctions Dealer 101

/BillofSale-d0a63400e8c942cab9b481536629f278.jpeg)

How To Write A Bill Of Sale For A Car

Free Car Vehicle Sales Receipt Template Pdf Word Eforms

Wisconsin Department Of Transportation Rolls Out New Law On Selling A Car Private

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Which Cities And States Pay The Most And Least For Cars Kfor Com Oklahoma City

Free Wisconsin Motor Vehicle Bill Of Sale Pdf Eforms

Free Wisconsin Motor Vehicle Bill Of Sale Pdf Eforms

What Is The Sales Tax On A Car In Illinois Pasquesi Sheppard Llc

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Who Pays Taxes On A Gifted Vehicle Sell My Car In Chicago

How To Buy A Car From A Private Seller Carfax

Trade In Car Or Sell It Privately The Math Might Surprise You

Free Vehicle Private Sale Receipt Template Pdf Word Eforms