mass tax connect make estimated payment

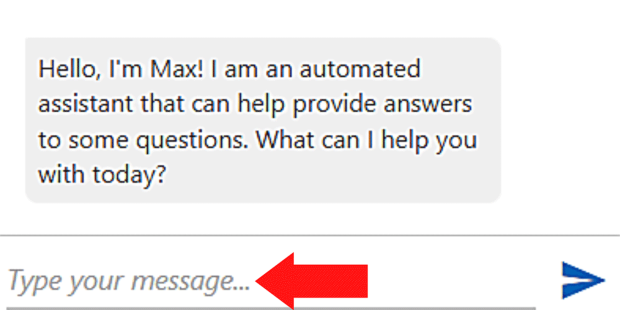

The reason why it is an estimated tax payment is because you. From the MassTaxConnect homepage select the Make a Payment hyperlink in the Quick Links section.

Masstaxconnect Resources Mass Gov

Youll learn how to pay a tax bill or make an extension or estimated tax payment using the Make.

. How to pay Massachusetts taxes. The Massachusetts Department of Revenue DOR replaced their existing e-filing system WebFile for Business in 2015 with a new online tax system called MassTaxConnect. Business and fiduciary taxpayers must log in to make estimated extension or return payments.

Business taxpayers can make bill payments on MassTaxConnect without logging in. Make a Payment with MassTaxConnect. If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667.

Its fast easy and secure. With estimated taxes you need to pay taxes quarterly based on how much you expect to make over the course of the year. Go to massgovmasstaxconnect for more information.

Use this link to log into Mass Depa. Read on for a step by step guide on making tax payments in MA. With a MassTaxConnect account you will also have.

Download or print the 2021 Massachusetts Form 1-ES Estimated Income Tax Payment Vouchers for FREE from the Massachusetts Department of Revenue. Massachusetts Income Tax Calculator 2021. The first step in making estimated tax payments is to calculate what you owe.

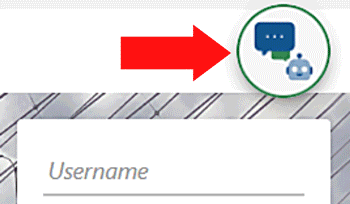

Make estimated tax payments online with MassTaxConnect. Make your estimated tax payment online. ONLINE MASS DOR TAX PAYMENT PROCESS STEP 1.

Tax payments can be made on MasstaxConnect with. Select Payment Type choose Return Payment for year 2019 if paying the balance due on your 2019 income tax return OR Estimated Payment for tax year 2020 if you are paying your 2020 quarterly taxes. We help users connect with relevant financial advisors.

Simply enter the amount you are paying and. Paying electronically is fast easy and secure. PO Box 419540 Boston MA 02241-9540.

247 access to view your payment history. The payment dates for Massachusetts estimated taxes are April 15 June 15 Sep. If you dont have a MassTaxConnect account start by creating a username.

Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth. Electronic Payment Options Make your estimated tax payments online at massgovmasstax-connect and get immediate confirmation. Call 617 887-6367 or 800 392-6089.

Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth. Select the Business payment type radio button. Enter the Business name.

Call 617 887-6367 for information on the payment agreement up to 5000 and 617 887-6400 for 5001 or more. Access account information 24 hours a day 7 days a week. The statewide sales tax rate of 625 is among the 20 lowest in the country when including the local taxes collected in many other states.

The Massachusetts income tax rate is 500. Note- An individual taxpayer is not required to create an account on the website to be able to make estimated. The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide.

Massachusetts Income Tax H R Block

Tax Free Weekend August 13 14 2022 Mass Gov

Tax Guide For Pass Through Entities Mass Gov

美國報稅 美國買房與自住房不能錯過的8項稅務優惠 省稅 節稅 Tax Refund Income Tax Brackets Estimated Tax Payments

Pocket Gbc Machined Aluminum Shell In 2022 Ir Led Battery Holder Aluminum

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

Massachusetts Income Tax Calculator Smartasset

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

A Guide To Estate Taxes Mass Gov

April 19 2022 Is Income Tax Filing Deadline Mass Gov

French Connection Aimee Abstract Print Tiered Midi Skirt Brown Patina Cream Tiered Midi Skirt Midi Skirt Sophisticated Shirt

Masstaxconnect Resources Mass Gov

Penalties For Filing Your Tax Return Late Kiplinger

Advance Payment Requirements Mass Gov